Our Credit Cards

Traveling with points and miles is not just about saving money—it’s about making dreams accessible, turning aspirational journeys into unforgettable experiences, and unlocking the world without boundaries.

My Chase Sapphire Is Better Than Your Chase Sapphire!

If you think all Chase Sapphire cards are created equal, think again. As seasoned travelers and points enthusiasts, we've discovered that the real value lies not just in having a Chase Sapphire card—but in how you use it, and which specific offers and strategies you leverage. Let’s break down why “my” Chase Sapphire can come out ahead of “yours,” even if we’re both holding a shiny blue card.

Maximizing Offers: Not All Sapphires Are the Same

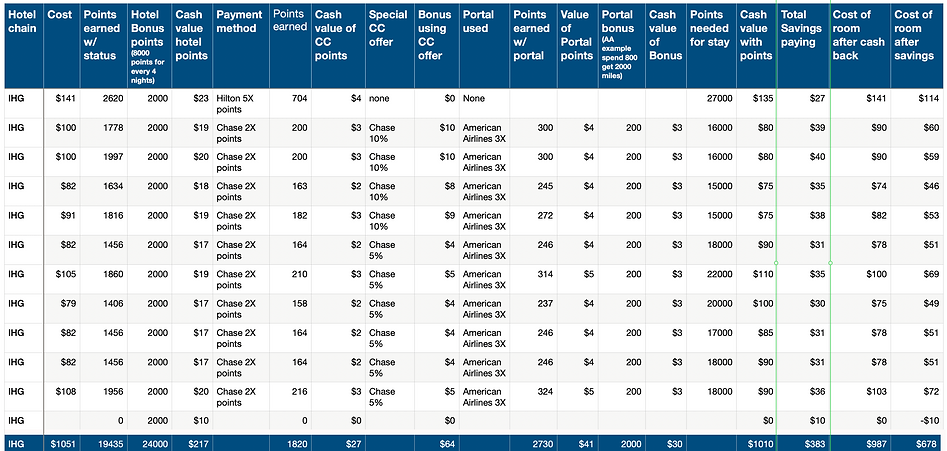

One of the biggest misconceptions is that the Chase Sapphire Preferred and Reserve cards always deliver the same value on travel bookings. In reality, Chase frequently rolls out targeted offers—like 10% or 5% cashback on IHG stays—that are only available on select cards or for limited periods. For example, during a recent hotel booking spree, one card was eligible for 10% cashback on IHG stays, while another only offered 5%. By strategically using the card with the higher cashback, we saved significantly more on our hotel expenses.

Stacking Rewards: The Power of Portals and Multipliers

Beyond the base rewards, savvy cardholders know to stack benefits. Booking through shopping portals like Rakuten or the American Airlines portal can earn you additional points or miles on top of what you get from your credit card. For instance, booking a $100 hotel room through the American Airlines portal with a Chase Sapphire card not only earned us the standard points but also an extra 300 American Airlines miles—worth about $4—plus the cashback from Chase.

When Paying Cash Beats Using Points

It’s tempting to use points for every booking, but sometimes paying cash (and earning points) is the better move. In our analysis, paying $141 cash for a night at an IHG hotel earned us $23 in IHG points (thanks to Diamond status and promotions) and $4 in Hilton points by using a Hilton card for the spend. The total value received was higher than if we had simply redeemed points for the stay.

The Spreadsheet Doesn’t Lie: Real Savings Add Up

After booking 11 hotel nights, the total cash outlay was $1,051. But by maximizing cashback offers and stacking rewards, the net cost dropped to $673—plus we earned over $300 in additional points and miles. If we had just used points, the equivalent value would have been $1,100, meaning the strategic use of the right Chase Sapphire card (with the right offers) saved us hundreds of dollars.

Why “My” Sapphire Wins

Here’s the secret: it’s not about which Chase Sapphire card you have, but how you play the game. The winner is the cardholder who:

-

Tracks and activates targeted cashback offers (like 10% on IHG stays)

-

Uses shopping portals to stack extra points or miles

-

Calculates whether to pay cash or use points based on current promotions and earning rates

-

Switches cards when cashback limits are reached to maximize every dollar

Key Takeaways

-

Not all Chase Sapphire cards are equal at any given time—offers vary.

-

Stacking rewards through portals and promotions can dramatically increase value.

-

Sometimes paying cash (with the right card and offers) beats using points.

-

Strategic use of multiple cards and offers can result in hundreds of dollars in savings per trip.

So next time you hear someone brag about their Chase Sapphire, ask them: Are you really maximizing it? Because with the right strategy, “my” Sapphire can definitely be better than “yours”—and the numbers prove it.

“If you’re a full-time traveler and you’re using these credit cards and you’re using points and miles, you really should think about using the portals to get extra points on it... it just makes sense to go ahead and put these things through the portal and utilize the correct credit cards to make sure you’re getting the appropriate cashback amounts too.”

Happy travels—and may your Sapphire always shine brighter!

Why We Love Our IHG Chase Credit Card

As frequent travelers and loyal IHG fans, our IHG One Rewards Premier Credit Card from Chase has become an essential part of our travel toolkit. While there are plenty of hotel credit cards out there, few deliver the ongoing value and flexibility that this card offers — especially when you factor in the incredible fourth night free benefit.

Below, we’ll share why this card stands out and how the fourth night free perk can transform your travel strategy.

Unbeatable Value for IHG Loyalists

The IHG One Rewards Premier Credit Card packs a punch with its suite of benefits:

-

Anniversary Free Night: Every year, you receive a free night certificate valid at IHG hotels costing up to 40,000 points — and you can top up with points if your dream stay costs a bit more.

-

Automatic Platinum Elite Status: Enjoy perks like room upgrades, late checkout, and bonus points on stays — just for holding the card.

-

Generous Earning Rates: Earn up to 26x points per dollar at IHG properties, plus solid rewards on travel, dining, gas, and everyday purchases.

-

Travel Protections: Get trip cancellation/interruption insurance, baggage delay, lost luggage reimbursement, and purchase protection.

-

No Foreign Transaction Fees: Perfect for international travel.

-

Statement Credits: Receive up to $120 every four years for Global Entry, TSA PreCheck, or NEXUS application fees, and up to $50 in United TravelBank cash per year.

But the real star of the show? The fourth night free benefit.

The Fourth Night Free Benefit: How It Works and Why It’s So Valuable

What Is It?

When you redeem IHG points for a stay of four or more consecutive nights, every fourth night is completely free — no points required for that night. This isn’t a rebate or a discount; the actual fourth night is zero points, even if it’s the most expensive night of your stay.

Key Features:

-

Unlimited Use: There’s no cap — use this perk as many times as you want each year.

-

Works on Longer Stays: For stays of 8, 12, or more nights, every fourth night is free (so, 8 nights = 2 free nights, 12 nights = 3 free nights, etc.).

-

Automatic Application: Just search for a four-night award stay while logged into your IHG account, and the discount is applied automatically — no hoops to jump through.

-

Maximizes Point Value: Because IHG uses dynamic award pricing, if the fourth night is more expensive than the others, you save even more.

How Much Can You Save?

Let’s say you’re booking a four-night stay at an IHG hotel where each night costs 30,000 points. Normally, that would be 120,000 points. With the fourth night free, you pay just 90,000 points — a 25% savings. If the fourth night is priced higher than the others (which can happen with dynamic pricing), your savings could be even greater.

Why It’s a Game-Changer

-

Longer, More Relaxing Trips: The fourth night free makes longer stays much more affordable, encouraging you to extend your vacation without burning through extra points.

-

Perfect for Family or Group Travel: Booking multiple rooms? The savings multiply.

-

Great for International Adventures: With no foreign transaction fees and thousands of IHG hotels worldwide, you can use this benefit almost anywhere.

-

Stack With Other Perks: Combine with your annual free night, Platinum Elite upgrades, and other card benefits for an even better experience.

Real-World Example

“On an upcoming trip, we booked a four-night stay at the InterContinental Grand Seoul Barnes hotel in South Korea using points. The room would have cost us 228,000 points for the four nights without the IHG card, but with the card we only paid 181,000 points. With our IHG Premier Card we saved 47,000 points, enough for another night elsewhere!”

Final Thoughts

The IHG One Rewards Premier Credit Card is more than just a way to earn points — it’s a tool for unlocking richer travel experiences at a fraction of the cost. The fourth night free benefit alone can easily justify the card’s modest annual fee, especially if you stay at IHG properties a few times a year.

If you love exploring new destinations, value flexibility, and want to make your points go further, this card — and especially its fourth night free perk — is hard to beat.

Ready to book your next adventure? Don’t leave a free night on the table!